Get money fast and easy at every point with Okash loan app. Do you have an emergency situation and you need money urgently? Okash loan app is the best app to cover all emergency funding. This article contains everything you need to know about the Okash loan app.

In this article, we will be giving a detailed explanation of the app’s interest rate, loan requirements, USSD code, and how you can successfully download the loan app and borrow money as fast as possible.

About Okash Loan App

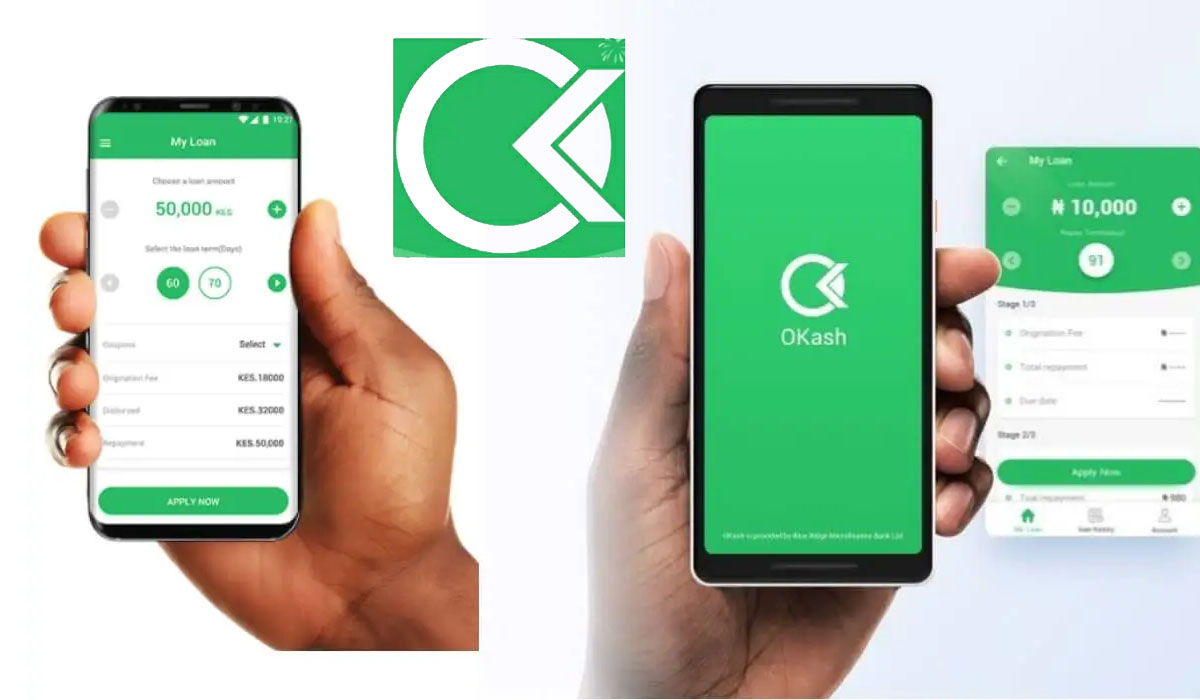

Okash Loan is a convenient personal loan platform for Nigerian mobile users. The loan platform is one of the leading mobile-based digital lending establishments in Nigeria.

It is owned by the Blue Ridge Microfinance Bank. The app was founded and launched in 2015 with the aim of providing quick and convenient access to short-term loans for interested individuals who need urgent funds.

The loan platform aims to ensure a streamlined loan application and approval process. Thus, making it faster and more accessible than traditional lending methods.

The loan app is functional in Nigeria, Kenya, and India and so far, it has successfully gained the trust and support of a lot of users due to its professionalism. Currently, they have over 5 million app downloads just from the Google Play Store and it’s still counting.

Are you wondering why the app is the user’s best choice? Well, this is due to their amazing features like quick loan approval, flexible loan amount transparent terms, convenience, improved credit score, and lots more.

The app allows users to borrow from N3,000 up to N500,000 and they are also allowed to pay back within 91 to 365 days. This is something you won’t want to miss out on.

Okash Loan Pros

- Fast and secure processing of loan payments

- No collateral and deposit requirements.

- Easy sign-up process

- They offer incentives such as bonuses from time to time.

- You can do the whole process online on your mobile phone. You don’t have to pay a physical visit.

Okash Loan Cons

- Privacy concerns

- The cost of loan repayment is high. There are other cheaper options

- Loans are for short-term

- It has the maximum amount you can borrow.

Okash Loan Interest Rate

The loan app offers an amazing market interest rate. They, however, charge 1.2% per day for a fixed term of 15 days. For example, if you borrow a sum of N20,000 from the loan app with a 1.2% daily interest rate for a 15-day term, you will repay the sum of N23,600 at the end of the 15 days. This includes both the principal amount and the interest charged by the loan app.

Okash Loan App Requirements

Okash approve loans based on certain requirement. Notwithstanding, the amazing part of this is that its requirements are light and not burdensome. Unlike other loan establishment that requires conditions like collateral, a guarantor, a high credit score, and more. Okash demands are not high. Below are listed requirements for loan approval on Okash.

- The applicant must be a resident of Nigeria

- A valid ID card is needed

- You must have a BVN

- Before applying for the loan, you must have a source of monthly income or state the reason why you want the loan before it can be approved

- The applicant must be in the age range of between 20 to 55 years.

- You must have a valid ATM card

- Ensure you have an active email, as it will be required

- You must have a bank account

- To make the loan application you need a responsive mobile or computer device

Okash Loan App Download

In order to access the loan app you will have to download the app on your device. On this page, we will be giving you a step-by-step guide on how to download the loan app on your device.

- Turn on your internet connection

- Location an app downloader app launcher on your device. This can be Google Play, Palm Store, and others.

- Use the search bar to search for the app

- When you find the app, click on it and tap the install button to download and install the app. Wait for a while for the app to download and install.

- Click open when the app is fully downloaded.

Follow the above steps carefully and you will be able to successfully download the application on your device.

How to Borrow Money From Okash

Haven knows much about the application, we are certain you must be wondering how to borrow money from the app already. Well, worry no more as we will be telling you all you need to know.

To borrow money from OKash, you will have to open the app, locate the loan section, and go through the loan eligibility for approval.

Read the terms and conditions and look out for the interest rate and the repayment date. Ensure you add all the needed required information and documents and confirm your loan request and you will get the loan within minutes if you have confirmed all your information is correct.

Okash Loan USSD Code

Here are simple steps to loan on Okash using the USSD code:

- First, dial *955#, using the number you registered your Okash account with.

- Then, choose the “loans” options.

- Next, apply for the loan eligible for you

The loan will be sent to your account when the process is fully completed.

How To Repay Okash Loan

Below are steps to follow when making repayment:

- First, open the loan app

- Login to your account

- Then, click on the button that says “make a repayment”

- Input all the needed information requested

- Click on the “repay” button

When you are done, you will be automatically debited from your bank account linked to the app.

Okash Loan App for iPhone

For now, the Okash Loan App is not available for iOS or iPhone users. To borrow money from Okash, you will need an Android phone. We will update you as soon as the app is available for iPhone users.

How much can I Borrow from Okash for the First Time?

Well, the minimum amount you are allowed to borrow for the first time is 30,000 Naira and a maximum of N50,000. The loan app is very flexible and user-friendly.

Why was my Okash Loan Application Rejected?

There are lots of reasons why your application can be rejected some of which include:

- Poor credit scores

- Poor levels of financial transactions

- Wrong information input